Small Business Coronavirus Relief Started April 1st: How Can My Business Qualify?

What programs in the recent relief bills help small businesses?

In March 2020, the federal government passed three multi trillion-dollar relief bills which represent the largest economic stimulus in US history.

- The Coronavirus Preparedness and Response Supplemental Appropriations Act–Passed March 6, 2020

- Families First Coronavirus Response Act (FFCRA)–Passed March 18, 2020)

- Coronavirus Aid, Relief, and Economic Security (CARES) Act–Passed March 27, 2020

Small Business Tax Credits and Forgivable Loans

In this article, we focus on two small business relief programs created in March 2020 and the PPPFA which modified one of them. The first two are part of the second and third bills. The PPPFA was passed in early June. The programs we address are:

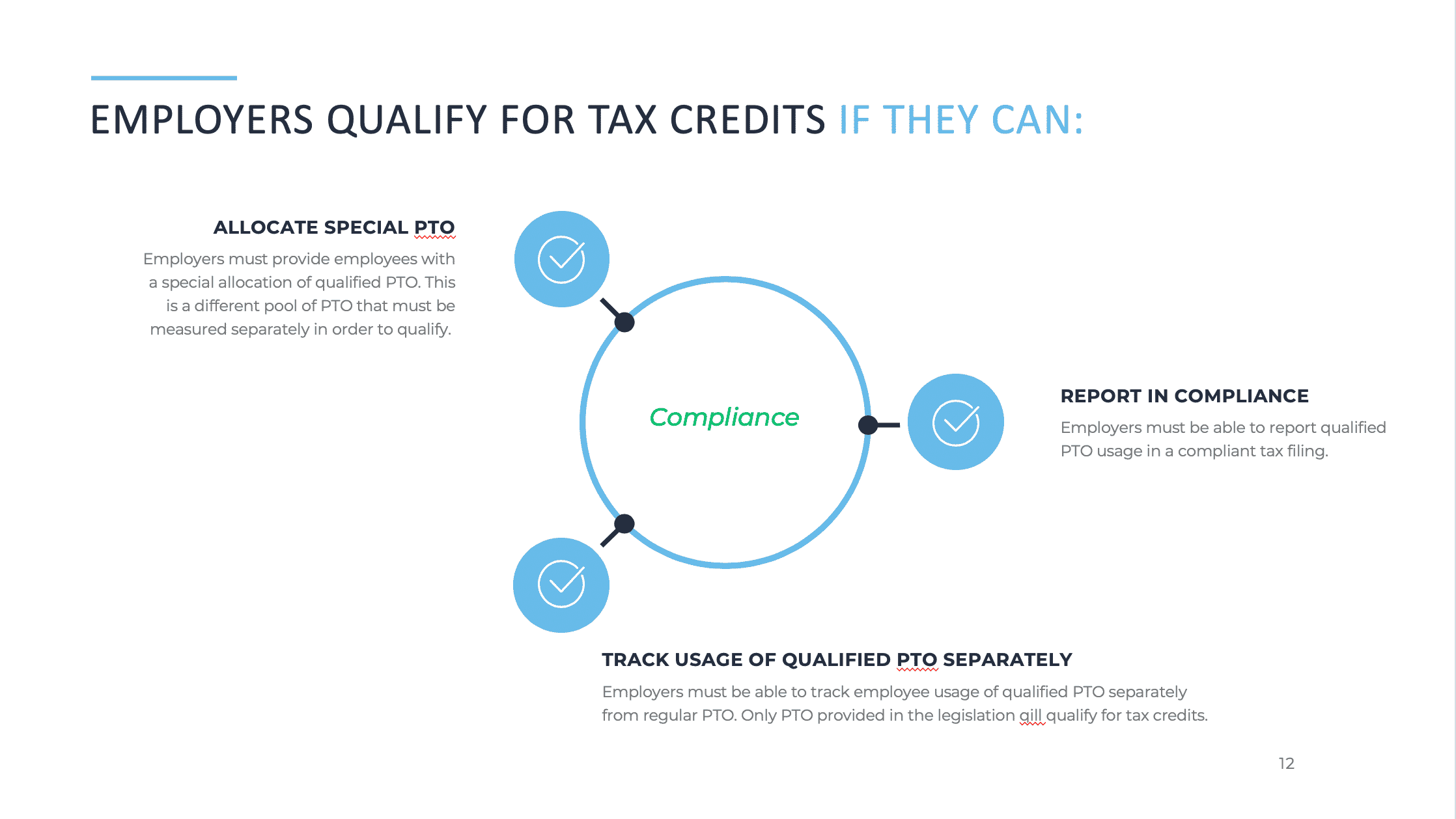

- Tax Credits for Paid Sick and Paid Family and Medical Leave (Part of the FFCRA)

- Paycheck Protection Program (Part of the CARES Act)

- Paycheck Protection Program Flexibility Act (PPPFA)

Tax Credits for Paid Sick and Paid Family and Medical Leave are part of the FFCRA that includes the EPSLA and the expansion of the Family and Medical Leave (FMLA). The Paycheck Protection Program is part of the CARES act.

What are most important things for small businesses to do right now?

It’s understandable if you feel overwhelmed right now. Many business owners do. Let’s take things one step at a time. First;

- Track employee hours for at-home, onsite, and mobile employees

- Don’t cut wages, furlough employees, or lay off employees before you learn what you can qualify for

The Emergency Paid Sick Leave Act

What is the EPSLA?

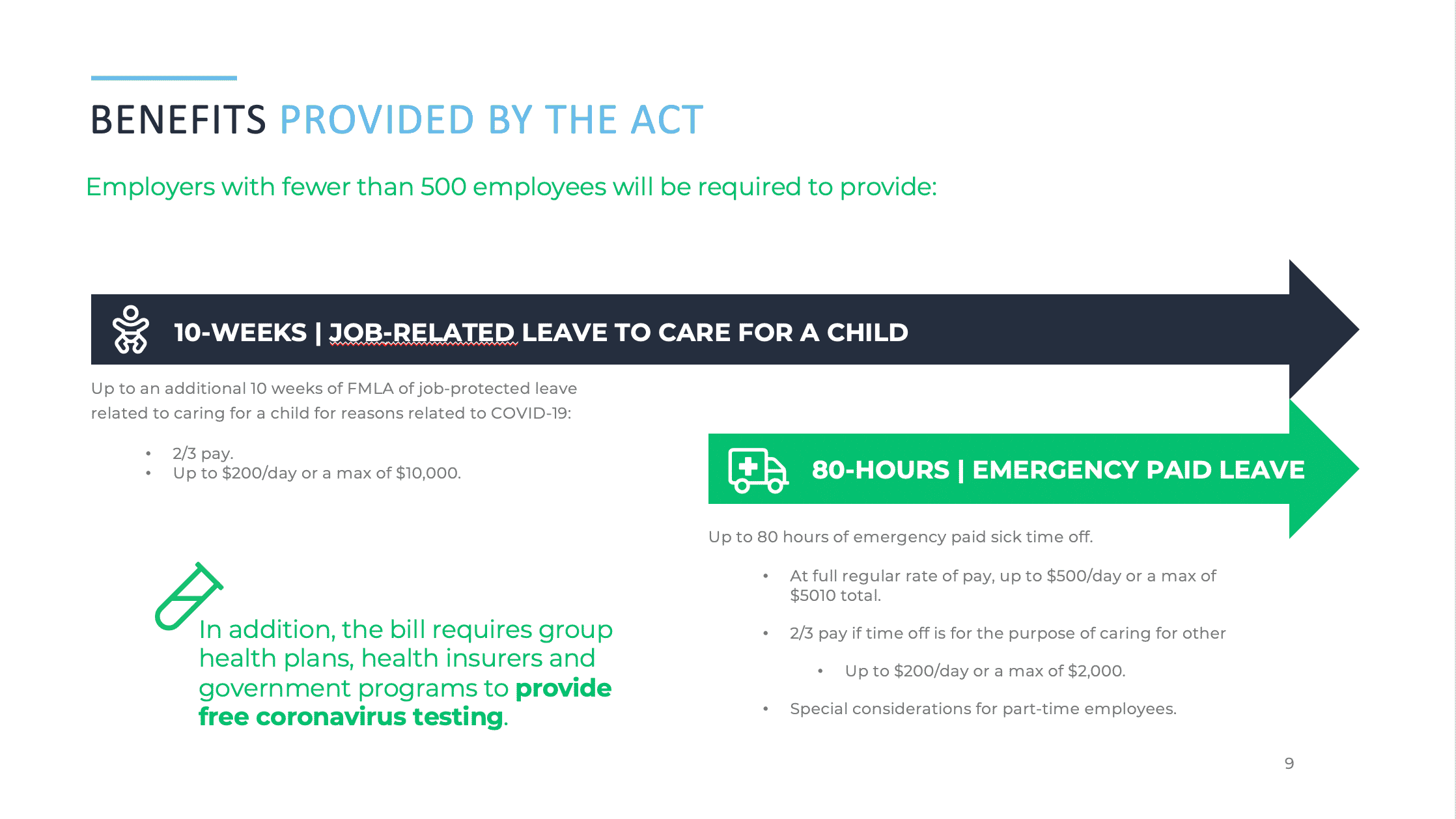

The FFCRA requires employers to provide paid leave through two separate components;

- The Emergency Paid Sick Leave Act (EPSLA)

- Emergency Family and Medical Leave Expansion Act (Expanded FMLA)

The EPSLA is the second law contained in the FFCRA that provides paid leave. Specifically, it provides full-time employees up to 80 hours (two weeks) of paid sick leave for basically the same coronavirus related reasons as outlined in the EFMLEA.

We will now answer employers’ frequently asked questions regarding these programs.

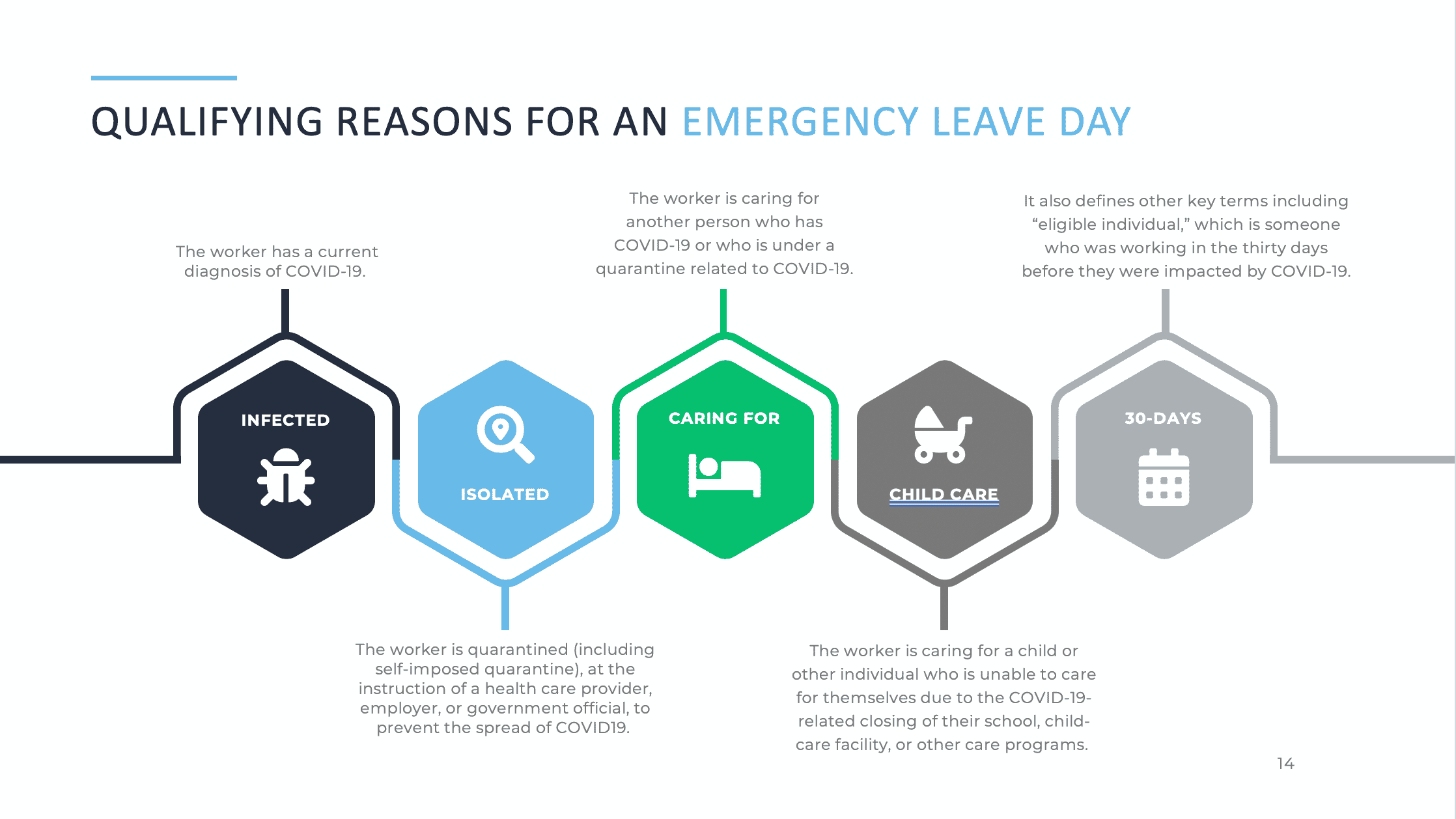

How does an employee qualify for leave under the programs?

You will recognize that many of these qualifiers are contained in FMLA. The notable addition is that employees may qualify if they are unable to work because the employee must care for a son or daughter whose school or daycare is closed due to a public health emergency or if the employee is under a quarantine order by any jurisdiction.

What if an employee has already taken FMLA leave? Are they eligible for emergency paid leave?

Yes, if you are a covered employer, an employee can take sick leave under the Emergency Paid Sick Leave Act in the FFCRA.

What if the employee hasn’t been employed for six months?

Use the number of hours agreed upon when hired. If the six-month average cannot be tallied because the employee has not been employed for at least six months, use the number of hours that you and your employee agreed to when hired.

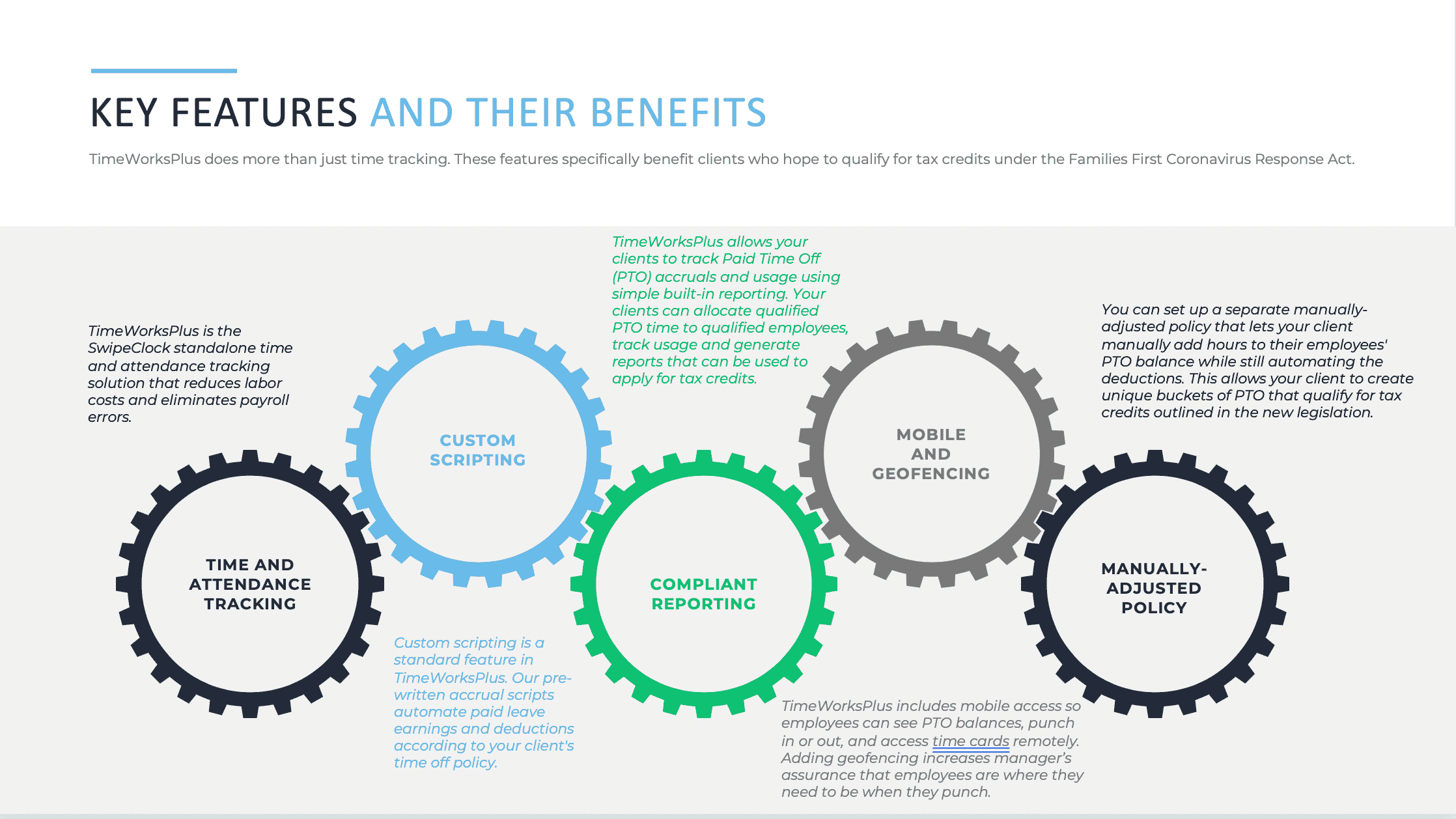

What is the easiest way to track employee hours, PTO accruals, and overtime?

Employee time tracking systems create online timecards as employees log their hours with an online web clock. They also track PTO, sick leave, and overtime.

I can’t wait until I file my taxes next year to get reimbursed for the sick leave wages. How can I make payroll right now?

The answer to this question brings us to the second topic of this article, The Paycheck Protection program.

The Paycheck Protection Program (PPP)

The PPP component in the CARES act is designed to provide loans to businesses to cover qualified operating expenses for a limited period. If the requirements are met, the loan can be forgiven. The Small Business Administration (SBA) will administer this program.

UPDATE JUNE 9, 2020: Last week, President Trump signed the Paycheck Protection Program Flexibility Act (PPPFA) which modifies the requirements of the original PPP.

How does the PPPFA change the original program?

The PPPFA is designed to expand the PPP and provide relief to more small businesses. Three of the main changes are:

- Extend the covered period of loan forgiveness from 8 weeks to 24 weeks.

- Provide a safe harbor from reductions in loan forgiveness based on reductions in full-time equivalent employees for borrowers that are unable to return to the same level of business activity the business was operating at before February 15, 2020.

- Provide a safe harbor from reductions in loan forgiveness based on reductions in full-time equivalent employees, to provide protections for borrowers that are both unable to rehire individuals who were employees of the borrower on February 15, 2020, and unable to hire similarly qualified employees for unfilled positions by December 31, 2020.

For a more details about the PPPFA, see the U.S. Small Business Administration.

What types of business operating expenses apply?

- Payroll

- Utilities

- Rent

- Interest on mortgage debt

- Health insurance costs

Employers face no payroll tax liability. Self-employed individuals receive an equivalent credit.

State Programs for Small Business Pandemic Relief

How likely your business is to survive the pandemic can be heavily influenced by where it is located. To find out what your state offers, visit US States’ Small Business Support Amid the Coronavirus Pandemic

What should small business owners do right now to determine if they qualify for a Paycheck Protection Loan?

- Look at your payroll to see if you kept the employees you had

- If you reduced your staff, there will be a reduction in loan forgiveness available

- If you’ve cut wages by 25%, that dollar value will affect the loan forgiveness as well.

The [Paycheck Protection] law allows businesses to take out loans equal to 2.5 times their average monthly payroll from 2019, so you need to know what that payroll number is. It should include salary and wages, of course, but also health care benefits and paid sick leave.Neil Bradley, EVP US Chamber of Commerce – Explanation of March 27th, 2020 Stimulus Bill in Inc Q&A)

If you are in the rebuilding phase, make sure you explore all your options for government relief. Inexpensive employee timekeeping tools can help you track sick leave and verify loan forgiveness qualification.

Where can I find more information about tracking employee time, qualifying for tax credits or a Paycheck Protection Loan, or managing remote employees?

How Do I Pay Quarantined Workers?

Use Geofencing to Track Remote Employees

What Are The Best Guidelines For Creating A PTO Policy For Your Business?

https://www.workforcehub.com/blog/how-to-buy-employee-time-clocks-for-small-business-in-2019-the-all-encompassing-guide/

Simplify HR management today.

Simplify HR management today.

Everything You Need to Know About the Corporate Transparency Act (And How It Impacts Your Business)

Staying current on legislation that may impact your business or impose new regulations is vital to remaining in compliance and avoiding costly fines. One piece of legislation that affects nearly all businesses under $5 million in gross revenue is the Corporate Transparency Act. If your business gross revenue comes in under that threshold and you…

Read MoreNavigating the Complexities of Healthcare Recruitment

The healthcare sector is renowned for its rewarding nature, offering professionals the chance to significantly impact individuals’ lives by aiding in their recovery from various ailments and conditions. However, for those tasked with recruitment within this sector, the challenges are plentiful. Delve into our in-depth guide for an array of strategies to elevate your healthcare…

Read More